-

![]() Australia

Australia -

![]() Australia

Australia -

![]() Australia

Australia -

![]() Australia

Australia -

![]() Australia

Australia -

![]() Australia

Australia -

![]() Australia

Australia -

![]() Austria

Austria -

![]() Austria

Austria -

![]() Austria

Austria -

![]() Austria

Austria -

![]() Austria

Austria -

![]() Austria

Austria -

![]() Austria

Austria -

![]() Belgium

Belgium -

![]() Belgium

Belgium -

![]() Belgium

Belgium -

![]() Belgium

Belgium -

![]() Belgium

Belgium -

![]() Belgium

Belgium -

![]() Belgium

Belgium -

![]() Brazil

Brazil -

![]() Brazil

Brazil -

![]() Brazil

Brazil -

![]() Brazil

Brazil -

![]() Brazil

Brazil -

![]() Brazil

Brazil -

![]() Brazil

Brazil -

![]() Canada

Canada -

![]() Canada

Canada -

![]() Canada

Canada -

![]() Canada

Canada -

![]() Canada

Canada -

![]() Canada

Canada -

![]() Canada

Canada -

![]() Chile

Chile -

![]() Chile

Chile -

![]() Chile

Chile -

![]() Chile

Chile -

![]() Chile

Chile -

![]() Chile

Chile -

![]() Chile

Chile -

![]() China

China -

![]() China

China -

![]() China

China -

![]() China

China -

![]() China

China -

![]() China

China -

![]() China

China -

![]() Colombia

Colombia -

![]() Colombia

Colombia -

![]() Colombia

Colombia -

![]() Colombia

Colombia -

![]() Colombia

Colombia -

![]() Colombia

Colombia -

![]() Colombia

Colombia -

![]() Costa Rica

Costa Rica -

![]() Costa Rica

Costa Rica -

![]() Costa Rica

Costa Rica -

![]() Costa Rica

Costa Rica -

![]() Costa Rica

Costa Rica -

![]() Costa Rica

Costa Rica -

![]() Costa Rica

Costa Rica -

![]() Denmark

Denmark -

![]() Denmark

Denmark -

![]() Denmark

Denmark -

![]() Denmark

Denmark -

![]() Denmark

Denmark -

![]() Denmark

Denmark -

![]() Denmark

Denmark -

![]() France

France -

![]() France

France -

![]() France

France -

![]() France

France -

![]() France

France -

![]() France

France -

![]() France

France -

![]() Germany

Germany -

![]() Germany

Germany -

![]() Germany

Germany -

![]() Germany

Germany -

![]() Germany

Germany -

![]() Germany

Germany -

![]() Germany

Germany -

![]() Greece

Greece -

![]() Greece

Greece -

![]() Greece

Greece -

![]() Greece

Greece -

![]() Greece

Greece -

![]() Greece

Greece -

![]() Greece

Greece -

![]() India

India -

![]() India

India -

![]() India

India -

![]() India

India -

![]() India

India -

![]() India

India -

![]() India

India -

![]() Italy

Italy -

![]() Italy

Italy -

![]() Italy

Italy -

![]() Italy

Italy -

![]() Italy

Italy -

![]() Italy

Italy -

![]() Italy

Italy -

![]() Japan

Japan -

![]() Japan

Japan -

![]() Japan

Japan -

![]() Japan

Japan -

![]() Japan

Japan -

![]() Japan

Japan -

![]() Japan

Japan -

![]() Mexico

Mexico -

![]() Mexico)

Mexico) -

![]() Mexico)

Mexico) -

![]() Mexico)

Mexico) -

![]() Mexico)

Mexico) -

![]() Mexico)

Mexico) -

![]() Mexico)

Mexico) -

![]() Netherlands

Netherlands -

![]() Netherlands)

Netherlands) -

![]() Netherlands)

Netherlands) -

![]() Netherlands)

Netherlands) -

![]() Netherlands)

Netherlands) -

![]() Netherlands)

Netherlands) -

![]() Netherlands)

Netherlands) -

![]() New Zealand

New Zealand -

![]() New Zealand

New Zealand -

![]() New Zealand

New Zealand -

![]() New Zealand

New Zealand -

![]() New Zealand

New Zealand -

![]() New Zealand

New Zealand -

![]() New Zealand

New Zealand -

![]() Norway

Norway -

![]() Norway

Norway -

![]() Norway

Norway -

![]() Norway

Norway -

![]() Norway

Norway -

![]() Norway

Norway -

![]() Norway

Norway -

![]() Philippines

Philippines -

![]() Philippines

Philippines -

![]() Philippines

Philippines -

![]() Philippines

Philippines -

![]() Philippines

Philippines -

![]() Philippines

Philippines -

![]() Philippines

Philippines -

![]() Poland

Poland -

![]() Poland

Poland -

![]() Poland

Poland -

![]() Poland

Poland -

![]() Poland

Poland -

![]() Poland

Poland -

![]() Poland

Poland -

![]() Portugal

Portugal -

![]() Portugal

Portugal -

![]() Portugal

Portugal -

![]() Portugal

Portugal -

![]() Portugal

Portugal -

![]() Portugal

Portugal -

![]() Portugal

Portugal -

![]() South Africa

South Africa -

![]() South Africa

South Africa -

![]() South Africa

South Africa -

![]() South Africa

South Africa -

![]() South Africa

South Africa -

![]() South Africa

South Africa -

![]() South Africa

South Africa -

![]() South Korea

South Korea -

![]() South Korea

South Korea -

![]() South Korea

South Korea -

![]() South Korea

South Korea -

![]() South Korea

South Korea -

![]() South Korea

South Korea -

![]() South Korea

South Korea -

![]() Spain

Spain -

![]() Spain

Spain -

![]() Spain

Spain -

![]() Spain

Spain -

![]() Spain

Spain -

![]() Spain

Spain -

![]() Spain

Spain -

![]() Sweden

Sweden -

![]() Sweden

Sweden -

![]() Sweden

Sweden -

![]() Sweden

Sweden -

![]() Sweden

Sweden -

![]() Sweden

Sweden -

![]() Sweden

Sweden -

![]() Switzerland

Switzerland -

![]() Switzerland

Switzerland -

![]() Switzerland

Switzerland -

![]() Switzerland

Switzerland -

![]() Switzerland

Switzerland -

![]() Switzerland

Switzerland -

![]() Switzerland

Switzerland -

![]() Taiwan

Taiwan -

![]() Taïwan

Taïwan -

![]() Taïwan

Taïwan -

![]() Taïwan

Taïwan -

![]() Taïwan

Taïwan -

![]() Taïwan

Taïwan -

![]() Taïwan

Taïwan -

![]() Thailand

Thailand -

![]() Thailand

Thailand -

![]() Thailand

Thailand -

![]() Thailand

Thailand -

![]() Thailand

Thailand -

![]() Thailand

Thailand -

![]() Thailand

Thailand -

![]() Turkey

Turkey -

![]() Turkey

Turkey -

![]() Turkey

Turkey -

![]() Turkey

Turkey -

![]() Turkey

Turkey -

![]() Turkey

Turkey -

![]() Turkey

Turkey -

![]() United Kingdom

United Kingdom -

![]() United Kingdom

United Kingdom -

![]() United Kingdom

United Kingdom -

![]() United Kingdom

United Kingdom -

![]() United Kingdom

United Kingdom -

![]() United Kingdom

United Kingdom -

![]() United Kingdom

United Kingdom -

![]() United States

United States -

![]() United States

United States -

![]() United States

United States -

![]() United States

United States -

![]() United States

United States -

![]() United States

United States -

![]() United States

United States -

![]() Uruguay

Uruguay -

![]() Uruguay

Uruguay -

![]() Uruguay

Uruguay -

![]() Uruguay

Uruguay -

![]() Uruguay

Uruguay -

![]() Uruguay

Uruguay -

![]() Uruguay

Uruguay -

![]() Vietnam

Vietnam -

![]() Vietnam

Vietnam -

![]() Vietnam

Vietnam -

![]() Vietnam

Vietnam -

![]() Vietnam

Vietnam -

![]() Vietnam

Vietnam -

![]() Vietnam

Vietnam

2015/03/16 - Financial public releases

2014 annual results

Results grow in 2014 following a strong second half

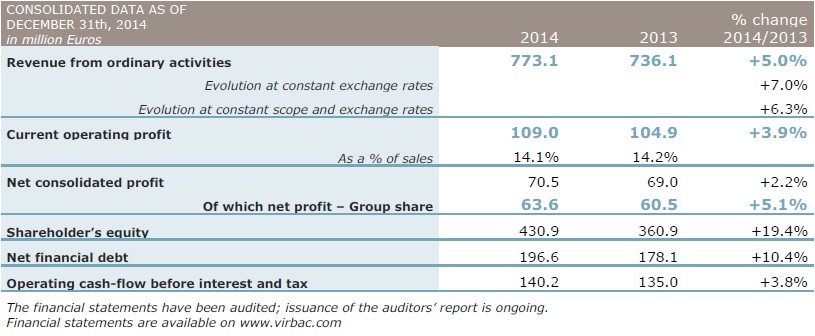

A 5.0% growth of revenue. After a very positive second half, Virbac’s real growth in 2014 reached +7.0% in total and +6.3% organically. The very unfavourable trends of exchange rates that prevailed in the first half started to reverse in the second part of the year, limiting a bit the impact of currencies on reported growth, which has reached +5.0% overall.

On a whole year basis, sales increased significantly in all regions of the world except in the United States, impacted by the absence of Iverhart Plus from the market before its re-introduction early July.

A 3.9% increase of current operating profit. As expected, Virbac’s financial performance during the second half has been much stronger than in the first half thanks to the acceleration of growth generated in this period and a better exchange rates environment. With this rebound, annual operating profit reached 109 M€ compared to 104.9 M€ in 2013, a growth of +3.9% and a profit ratio, as a percentage of sales, very close to last year.

This good overall performance has been favoured by a moderate evolution of operating expenses and the leverage resulting from sales growth, while being still negatively impacted by foreign exchange. In the meantime some factors weighted less favourably on the global margin, such as the increased manufacturing cost basis of the new facility for sterile injectable products which started operating in France; and the reduced relative weight in Virbac’s global business in 2014, of high margins businesses or markets such as aquaculture in Chile and the United States.

Net profit increases by +5.1%. After deduction of interest expenses, tax and minority interests, the net profit - Group share amounts to 63.6 M€, a +5.1% increase compared to 60.5 M€ in 2013.

Sound financial structure. The slight increase of net debt in 2014 is due to payments made for recent acquisitions, essentially Centrovet in Chile, in relation to contractual price adjustments. Excluding these, operating needs were significantly lower than in 2013 thanks to the decrease of capital expenditures after the completion of two major industrial projects in France and Mexico. Virbac’s financial structure is very solid, which will allow financing of the acquisition of products from Lilly in the U.S., closed early January, through additional debt.

2015 perspectives

With the general dynamics of the animal health market worldwide and the ramp-up of products recently launched, in Europe mainly but in other regions as well, organic growth in 2015 could be comparable to 2014. In addition, exchange

rates will have a positive impact on the overall performance, should the trends observed recently be confirmed with the decrease of the Euro.

The evolution of business in the first quarter will be, nevertheless, partially offset by a weak activity in the United States. Manufacturing and deliveries from its Saint Louis (Missouri) facility have been interrupted by Virbac’s U.S. affiliate early this year in order to reinforce and accelerate implementation of its improvement plan in regards of validation and quality assurance processes, after certain weaknesses have been pointed out during a recent inspection by the U.S. regulatory authorities. Deliveries are due to resume gradually during the month of March and manufacturing as from April.

The contribution of the Sentinel range acquired in the U.S. -which is not affected by the above event and reached 25 M$ in sales by the end of February- will be, on the other hand, very positive on Virbac’s growth of revenue and results on an adjusted basis. On a reported basis though, the application of IFRS accounting principles related to business combinations will generate significant annual amortization as well as a one off expense, in the first year, triggered by the accounting revaluation of the acquired inventory. These entries will lower the profits generated; their total impact is currently being reviewed by Virbac.